Insuring a commercial property provides owners with peace of mind and security. Should an accident, natural disaster, or another event that causes costly damage to a commercial property occur, insurance protects against unexpected costs and allows organizations to restore operations without jeopardizing the bottom line. Without commercial property insurance, a company could be placed at the risk of the unexpected.

Commercial insurance inspections are essential to providing quality coverage. Intended to verify a property’s condition, assess potential costs, and avoid future surprises, insurance inspections give insurers crucial, real-time information about the property. Incomplete or inaccurate commercial insurance inspections can lead to serious repercussions, potentially saddling insurers with high unexpected costs, potential for fraud, and unhappy customers.

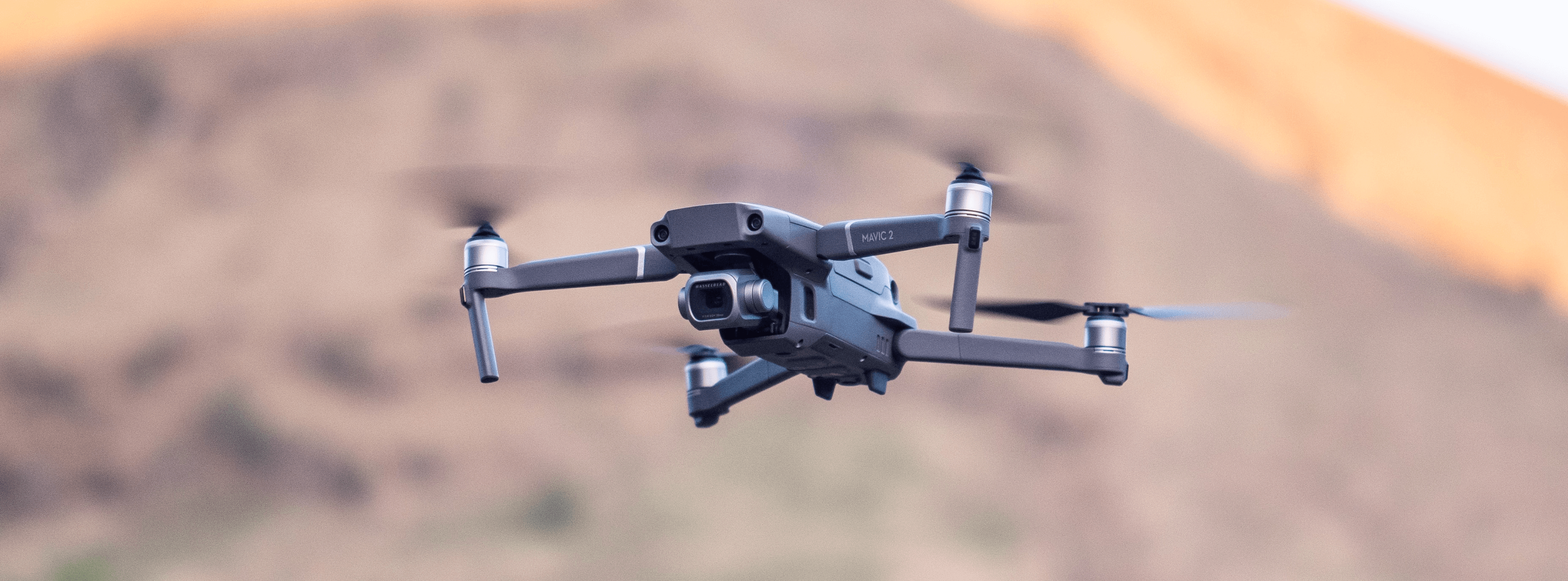

Traditional commercial insurance inspection have typically required inspectors to travel on-site, and climb a ladder to assess the conditions of a roof, running a higher risk of unexpected injuries. Depending on the size of the property, insurers have also contracted airplanes or satellite providers to provide additional imagery of hard-to-reach locations. Imagery captured by satellite companies or planes can have a longer turn-around time, be prohibitively expensive, be out of date, and have lower resolution.

DroneBase's drone imagery and Insights offer a scalable solution to improve the inspection process for commercial properties. Via the latest model drone systems, professional pilots can capture high-definition imagery of commercial property sites from a wide variety of vantage points. DroneBase is used by insurance underwriting departments for initial property inspection to access the condition of the property, nationwide.

Commercial property insurers can also use drone imagery and DroneBase’s thermal Insights roof reports for close, accurate assessments of the building conditions. Drones equipped with thermal sensors provide added levels of detail, such as water intrusion under the roof membrane otherwise difficult to detect with the naked eye. Combined with high-quality imagery, Insurers receive a complete view of a commercial property's condition.

Insurance underwriters tasked with evaluating the full risk profile of a commercial property can take advantage of a drone's ability to survey an entire landscape. Operated by a member of DroneBase's network of professional, highly-skilled drone pilots, drones provide commercial property underwriters with aerial imagery and roof condition reports to make informed decisions using an accurate, real-time record of a property's condition.

Drone inspection services provide a significantly safer alternative to traditional inspection methods. Available to capture detailed imagery of areas that are difficult to reach or pose a threat to human inspectors, DroneBase pilots can provide commercial property insurers with information about inspections that do not place agents or inspectors in harm's way. Climbing ladders, scaling roofs, or getting close to toxins or pollutants is not required when utilizing drone imagery, which can be crucially safe following an event such as a natural disaster.

DroneBase proudly oversees a network of more than 60,000 professional pilots in the United States. Experienced at carrying out more than 100,000 unique drone missions in more than 70 countries, DroneBase pilots readily support commercial property insurers tasked with claims processing and commercial underwriting. Throughout the insurance industry, DroneBase has assisted property inspectors reduce their inspection timelines down to two to three days and save an average of 11% on premium costs reserved for inspections.

DroneBase solutions for commercial property inspectors provide a safe, cost-effective, and fast alternative to traditional inspection methods. Reach out to us today for a free pricing quote or to request more information about our drone-based commercial property services.

.jpg?width=360&name=Banner%20Templates%20(12).jpg)