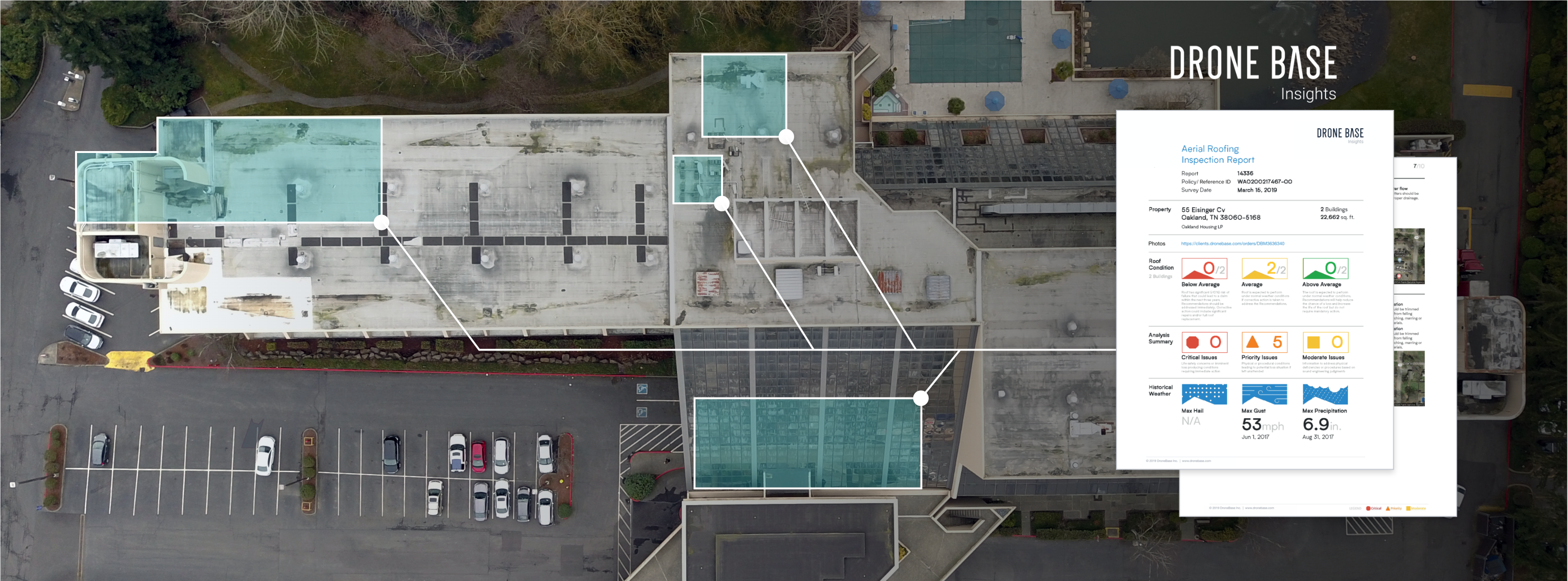

In 2019 we announced a new technology utilizing drone data to provide analysis and reporting in DroneBase Insights.

From then to now, we’ve worked with a wide range of customers throughout many different industries, ranging from providing accurate measurements to contractors scheduled for an installation, to unbiased roof condition analysis for property managers and insurers.

One company in particular seeing the benefits of DroneBase Insights Roof Reports is Central Insurance Companies.

About Central Insurance Companies

Central Insurance Companies is an insurance company based in Ohio, operating in more than 20 states. The company provides comprehensive property and casualty solutions for personal and commercial policyholders including home, auto, business property, liability, fleet, and worker's compensation insurance.

The Central Insurance team had previous experience working with drone technology and when DroneBase announced the acquisition of drone reporting technology from Betterview, the transition to working with DroneBase only made sense.

What were the Driving Factors in Transitioning to DroneBase Insights?

For Michael Vining, Loss Control Manager at Central Insurance Companies there were several driving factors:

-

"The safety of our consultants is something our company takes very seriously. DroneBase’s solution allows us to get the information we are seeking without putting the consultants on roofs and potentially compromising their safety."

-

"Like any other company, roof claims make up a large percentage of our paid out property claim dollars. That fact combined with not being able to adequately and safely evaluate roofs made us search out a vendor who could provide insightful imagery and data."

-

“The ability of DroneBase’s team to evaluate the imagery and offer solid recommendations is invaluable to Central. Without that offering our Loss Control and/or Underwriting team would not only have to spend the time to evaluate each photo, but also have to be extensively trained to understand what they are looking at and realize when there is an issue. Given all of the other tasks asked of an insurance professional, that time is not something we were/are willing to accept.”

How did your Workflows Change?

Michael Vining, Loss Control Manager at Central Insurance Companies says “The ability to focus our drone inspection resources was the biggest improvement. Central was one of the first companies to work with BetterView and their drone solution. When DroneBase purchased that product and network from BetterView, the transition was necessary.”

Using inspection and insights roof report services, Central Insurance Companies is able to gather reliable data to assess property conditions. The integration of drone technology allows the Central Insurance team to improve inspection efficiency and make smarter business decisions.

In addition to seamlessly transitioning customers from existing reporting methods to DroneBase Insights Reports, we strive to consistently improve the technology our customers are using through collaboration and feedback. “The workflow has not changed much but the focus and value of DroneBase’s report has increased substantially.” says Mr. Vining.

The Insights Roof Report now considers more than 70 roof conditions, including anomalies such as debris, water ponding, overhanging vegetation, and offers a detailed summary of issues and their severity through unbiased expert analysis.

How Have DroneBase Insights Reports Cut Costs and Saved Time?

Through the use of drone technology and our nationwide network of skilled pilots, DroneBase customers are able to complete contactless inspections faster, and at a fraction of the cost it would take to complete an inspection through traditional methods.

“Our relationship with DroneBase has provided Central much-needed data that has not only helped us in our selection of quality business but also allowed us to better price property-heavy accounts. With the safety of our consultants at the forefront of our efforts, oftentimes this comprehensive evaluation of roof characteristics and condition was previously unobtainable. DroneBase's contactless solution allows us to feel much better about our team’s safety and underwriting decisions.”

In addition to the safety benefits of utilizing drone technology, the Central Insurance team has seen the most drastic improvements in claim cost savings.

Mr. Vining says “The real benefit is the claim cost savings. While it is very difficult to measure when a claim is avoided, I do have several instances of DroneBase’s service providing the information needed to get off of an account. If we avoid one sizable claim per year, the product/program is worth the effort.”

The upsides of integrating with drone technology are immense and we’re excited to see our customers continuing to find added value in DroneBase Insights Reports. As we progress through 2020 and beyond, our team looks forward to growing the existing relationship and continued collaboration with Central Insurance Companies.

To learn more about DroneBase Insights Reports visit our website here.

.jpg?width=360&name=Banner%20Templates%20(12).jpg)

.jpg?width=360&name=Banner%20Templates%20(7).jpg)